Article Directory

Solana's "Explosive Growth Potential"? More Like Explosive Hopium.

The Solana Hype Train: Still Chugging Along?

Okay, so Solana's still kicking, apparently. Market cap "exceeding $14 billion" (according to someone), blah blah blah. Layer-1 blockchain designed for "high throughput and low transaction costs." Translation: they promise it's fast and cheap, when it's not crashing. Which, let's be real, is half the time.

And look at this gem: "SOL functions primarily as a utility token for transaction fees and staking, not as a speculative instrument alone." Oh, really? Tell that to the meme coin degens who treat it like a casino chip. I am so tired of the sanctimony.

I mean, sure, the article throws in some "key takeaways" about network throughput and ecosystem growth. 1,000+ TPS, DeFi and NFT activity expanding... It's the same sales pitch we've been hearing for years. But what about the actual user experience? What about the constant network hiccups and the validator centralization?

Speaking of validators, they are geographically diverse... in North America and Western Europe. Surprise, surprise. So much for decentralization.

And this "PoH + PoS" architecture? It's supposed to be so revolutionary, confirming transactions in "less than 400 milliseconds." But what happens when the network gets congested, huh? Then those milliseconds turn into minutes, and your NFT costs more in fees than the damn JPEG is worth.

Honestly, this whole thing feels like a carefully crafted PR piece designed to pump SOL's bags. "High staking reduces circulating supply, indirectly supporting SOL’s market stability." Translation: We're trying to make it look like there's real demand, even if nobody's actually using the damn thing.

But wait, let's talk about the real kicker: "SOL’s price remains influenced by Bitcoin and Ethereum trends, macroeconomic conditions, and regulatory developments." In other words, Solana's fate is tied to the same crap that affects every other crypto. So much for being a "revolutionary" Layer-1. You can read more about Solana's potential as an investment in this Solana Price Prediction: Is Solana a Good Investment? article.

DeFi's "Striking Dichotomy": A Polite Way of Saying "It's a Mess"

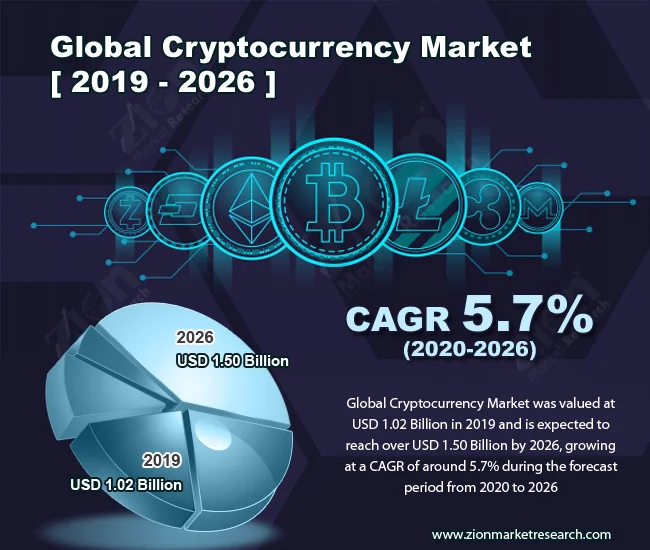

Now, let's flip over to this FalconX report on DeFi token performance post-crash. Apparently, only 2 out of 23 leading DeFi tokens are positive YTD. That's... not great. The group is down 37% on average for the quarter. Ouch.

Investors are supposedly "opting for safer names with buybacks." You know, the kind of desperate moves that companies make when they have no other way to boost their stock price. And these "safer names" are still down double digits QTD. So much for safety.

And this gem: "Certain DeFi subsectors have become more expensive, while some have cheapened relative to Sept 30, underscoring the changing landscape." Translation: Nobody knows what the hell is going on.

Spot and perpetual decentralized exchanges have seen declining price-to-sales multiples. But some DEXes posted greater 30-day fees. Which ones? The article doesn't say. Convenient, ain't it?

Lending and yield names have broadly steepened on a multiples basis because price has declined considerably less than fees. So, in other words, everything is overvalued. Great.

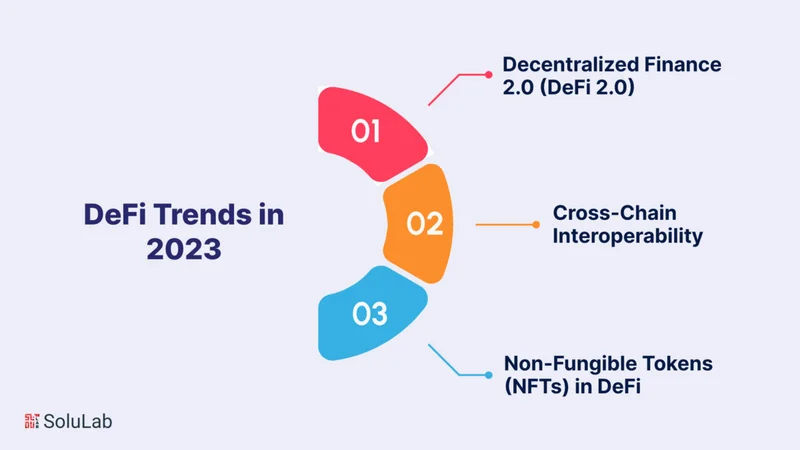

But hey, maybe I'm wrong. Maybe the DeFi sector will see growth in 2026. Maybe AAVE's high-yield savings account will be a game-changer. Or maybe it's all just hopium. What do I know? You can read more about the dichotomy in DeFi tokens in The Striking Dichotomy in DeFi Tokens Post 10.

So, What's the Real Story?

Look, let's be real. Solana is overhyped, DeFi is a minefield, and the entire crypto market is driven by speculation and empty promises. It's all a goddamn casino, and we're all just gambling our hard-earned cash on digital tulips. And anyone who tells you otherwise is either delusional or trying to sell you something. Full stop.